Lending Club (LC) is a peer to peer lending website that allows you to “be the bank” to get a better return on your money than letting it just sit in the bank. You lend your cash lump sum to many different people, but only giving a small micro loan (a $25 “note”) to each one to spread the risk. For example a typical note might be used by someone to pay off their credit card (at say 15%), while you get a decent return (of say 8%) on the money loaned. It is like running your own bond portfolio, where you can have low or high risk credit quality and have default risk on the more risky loans.

Lending Club’s website is here.

We have been executing a Lending Club (LC) Portfolio for the last 4 years which has been nicely successful, to the point of almost being boring – not much happens except interest payments (which are A GOOD THING) and limited defaults which are manageable and expected.

A brief portfolio history is that from 2012 to 2013 we increased Lending Club exposure significantly from USD cash savings, and were full allocated in Dec 2013. We then left the allocation at the full amount for about 20 months. However we have recently taken the action to liquidate about 60% of our exposure from Sept 2015 to Nov 2015.

This is based on several factors:

– Lending Club IPO fever from Dec 2014 has cooled off somewhat, with a declining stock price and worries on future regulation. Although Lending Club’s ongoing marketing means that the peer to peer lending is becoming much more main stream, and there is wider participation reaching individual investors. There hasn’t been a big consumer credit bear market yet, with lots of the general public involved (in 2009 peer to peer lending was more a niche market). Therefore it will be interesting to see what happens if/when everyone decides they have to liquidate their Lending Club account at the same time.

– We use the stock ticker JNK (junk bond fund) as a proxy for Lending Club style risk – its not perfect because LC is consumer credit debt and JNK is corporate debt, but it gives a relatively correlated benchmark to make decisions from. The credit market environment (distinct from the stock market) was not that volatile from 2012 to mid 2014, so we have been lucky to be in a good time period for Peer to Peer lending. However there has been a steady credit sell off since June 2014, and in early 2016 JNK has just entered a technical bear market (typically defined as a 20% or more decline from the most peak). Therefore we decided to dial back the risk. The following chart shows the story:

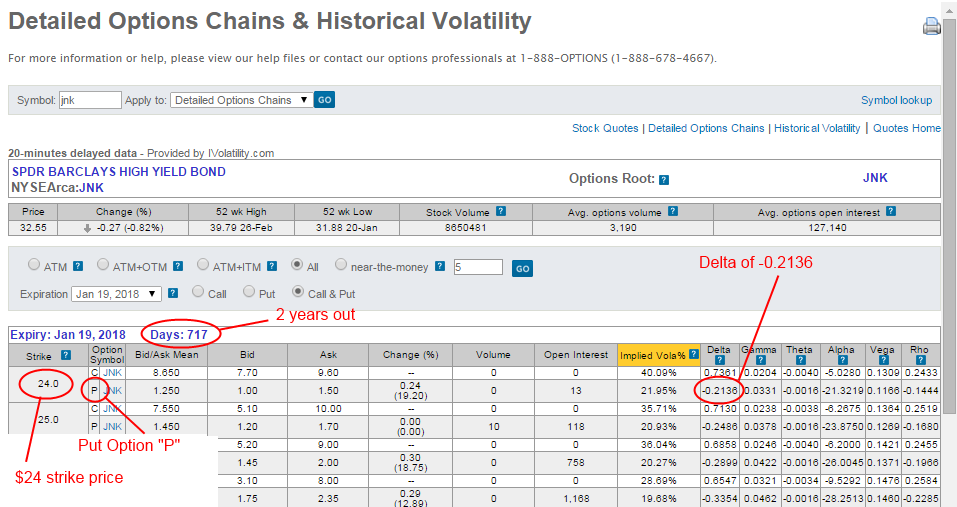

– Our portfolio size would take an estimated 3.5 months to exit comfortably at 1% premium in the current (relatively) decent market conditions. Our lending club allocation relative to the rest of our portfolio was getting to the size were it was “too big to fail” – i.e. given that we’d done pretty well for 3 years, if it all went horribly wrong from here and we hadn’t yet taken any profit along the way, we’d feel pretty stupid. After reducing exposure by 60%, the LC portfolio would have to fall by 25% for us to loss the profit already generated. That magnitude of move is possible, but The LC portfolio is now at a size where we’d be comfortable riding that out. Interestingly if you want to attempt to quantify how possible that move might be, you can look at JNK listed options to assign an approximate probability of that 25% decline happening by 2 years time. See screenshot below showing JNK options:

On 2nd Feb 2016 JNK price is $32.55, a 25% discount to that price is $24.41. So looking at approximately the same price strike in Jan 2018 options (about 2 years away) shows that the $24 put option has a -0.2136 delta. As a quick shorthand traders often use the option Delta as an approximation for the probability of that option finishing in the money (ITM). This means that JNK has about a 20% chance (approximating 21.36%) of finishing in the ITM by Jan 2018 (2 years time). Therefore if you believe that JNK is a reasonable for proxy LC debt, then you could estimate a 20% probability of losing 25% of your portfolio value in 2 years. The option market is usually pretty accurate, but its not a perfect methodology because it depends on how correlated you think JNK is to LC debt – but it’s a decent start at a quantifiable risk estimate (so you can decide if you are comfortable with the risk).

– We were finding it hard to allocate enough new cash with our (admittedly) strict criteria. Put simply there is not enough liquidity to do what we want to do, and since we do not want to compromise on credit quality, we are taking our ball and going home. Interesting in 2012/2013 we could not allocate the notes fast enough with the same criteria, but now there seems to be a big slow down in current liquidity for larger portfolios especially if you start being slightly more strict with the criteria. A good guess would be that the liquidity slow down might be due to automated APIs automatically bidding on note inventory.

– We are ramping up our Nova Scotia real estate investments which are some what market timing sensitive based on FX rate opportunity. Therefore we are simply being opportunistic – effectively this is profit taking from peer to peer lending and reallocating the capital to that real estate strategy.

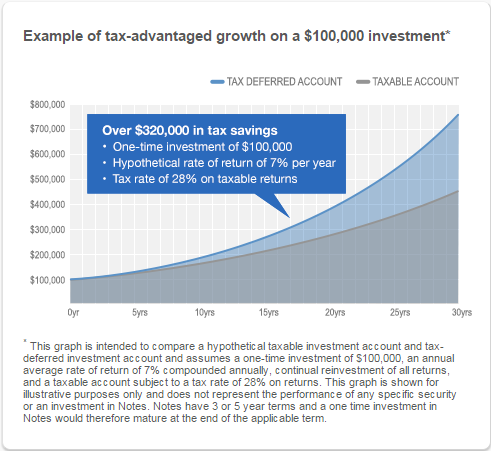

– The LC account is a taxable account, so it would be beneficial to start slowly re-allocating some assets over to an IRA (some already have been) to get the long term tax free impact of compound interest. In the early years, holding the portfolio the different in compound interest is not as great, but over several decades the impact of taxable (standard account) v. non taxable (IRA account) returns would be significant. See lending club’s chart included below and accessible here:

Re-balancing strategy

So how was the portfolio re-balancing done ?

Trading out of notes on LC is done using the FolioFN secondary market trading platform which actually charges a 1% transaction fee, so we always place our notes for sale at a 1% premium or greater. Effectively selling for a 1% premimum is like selling a note for par value (principal + pending interest) after taking into account the 1% transaction fee. We experimented with premiums of 2% to 5% and to be fair some small bids were hit, but it would probably have taken about 2 years or more (!) to exit the number of notes we wanted to get rid of.

In brief this was the exit strategy to sell 60% of LC portfolio:

1) Put entire portfolio up for sale at 1% premium on the FolioFN secondary market trading platform. Initially estimated we can liquidate notes about $1000 a day at a 1% premium, so we estimate it would take about 60 days to reduce the exposure. In the end it took about 75 days, but actually generally not a bad estimate. The platform is not super liquid, but there is enough demand from secondary market place – presumably from US states where people cant buy the first time around in the primary market.

2) Monitor every 2-3 days for about 75 days until the portfolio was 40% of its original size (60% exposure reduction). Finally delete all pending sell orders from the FolioFN trading platform.

3) Then re-balanced the portfolio to our required credit quality mix using Lending Club’s automated trading feature. This took about 35 days.

4) Monitor final results to confirm portfolio is correct size and credit quality mix. This was completed by 30th Dec 2015,

Total process from steps 1 to 4 took about 4 months to fully execute, but did successfully exit all notes at par (1% premium) or better. Time will tell if this was a good move, however it seems like prudent risk management/reallocation for now.

One thought on “Reducing Lending Club exposure”